Understanding the Concept of a Deal in FinverityOS

On FinverityOS, a Deal signifies a single financial facility established between at least one buyer/payer and one seller.

It is a structured agreement that outlines the critical aspects of a transaction's workflow. Essentially, a Deal serves as the blueprint for how a particular transaction will be processed and managed within the system.

Key Components of a Deal:

Parties Involved: establishes the formal relationship between the chosen buyer and the seller.

Product and Transaction Workflow: defines the specific steps and processes that will be followed to complete the transaction.

Pricing Structure: the pricing details within a Deal can vary based on predefined templates. If a floating rate is involved, it needs to be set up as a template within the system.

Funding Window: the funding window specifies the period during which the financial aspects of the Deal will be executed.

Limit: sets a maximum threshold for invoice purchases

Disbursement and Repayment set up: sets working day calendar for disbursement and repayment deadline calculation

Setting Up a Deal

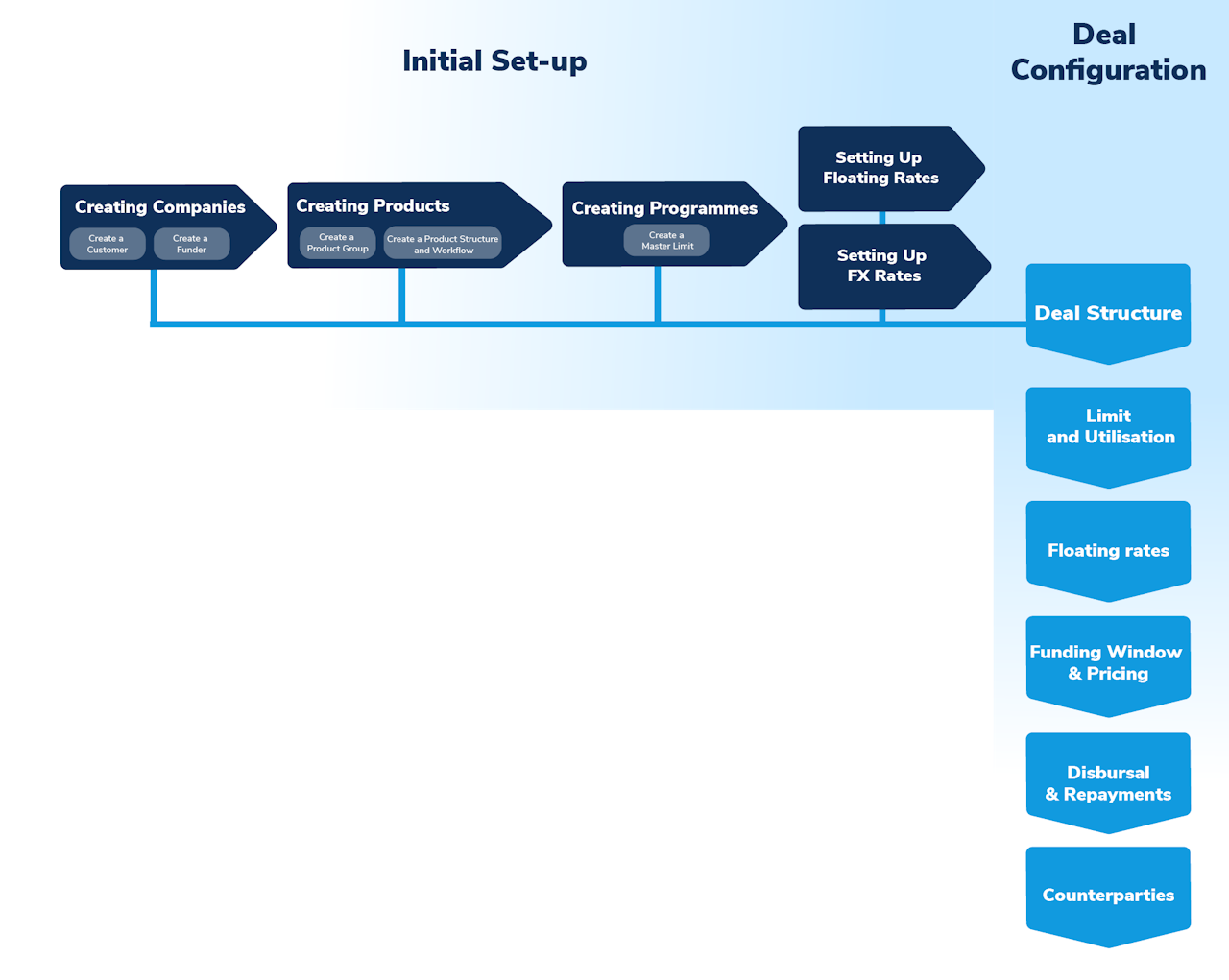

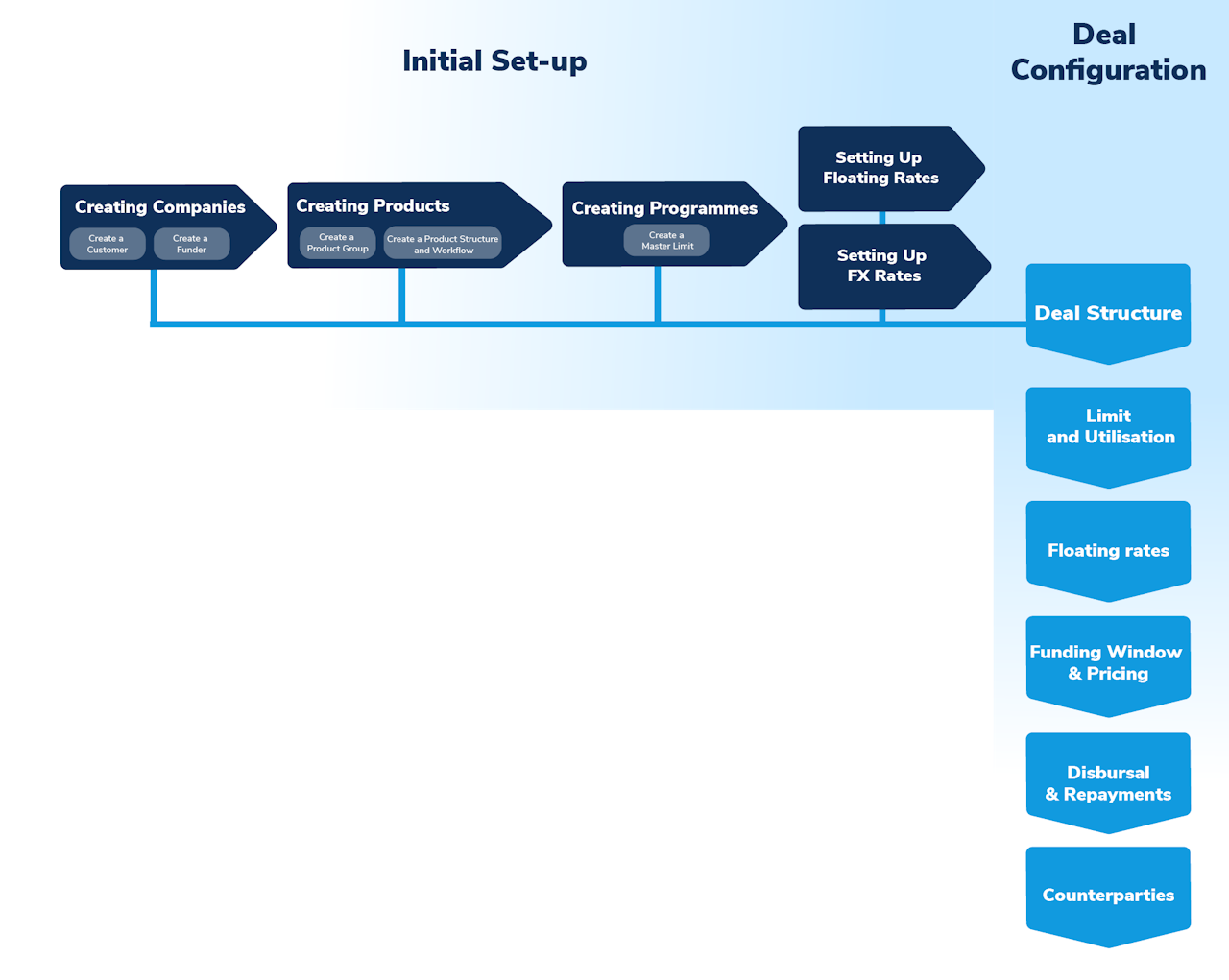

Creating a Deal in FinverityOS is a process that builds upon previously established setups. Here’s a step-by-step overview of the setup process:

🏢 Companies creation: the buyer, the seller (Customers) and the funding party (Funder) must be onboarded to the FinverityOS platform. This involves collecting necessary information, verifying credentials, and ensuring KYC compliance.

📝 Product Creation: Each deal will relate to a particular product (e.g. receivables, payables, purchase order finance, distributor finance) that will also regulate the Instrument Workflow.

💰 Programme Creation: A Programme is a collection of Deals (or a single deal) with the same Anchor, falling under a single Limit. You can set a global limit for a Customer and create different Deals (each with its own limit) controlled by that global limit.

💱 FX and Floating Rates Template Creation: If there are variable elements such as floating rates, these need to be established as templates within the system. Templates store repetitive information, making it reusable for future Deals.

📂 Deal Configuration: Once onboarding and template creation are completed, the specific Deal can be configured. This involves selecting the relevant parties, product and programme, applying the appropriate pricing template, and defining the funding window.

✅ Approval and Activation: After configuring the Deal, it undergoes an approval process (Maker and Checker) to ensure all details are correct. Once approved, the Deal is activated and ready for execution.