Pricing Structure within Funding Windows

Annualised fees and related late and penalty fees are configured per deal, at funding window level, and then applied automatically to all funded instruments that fall into that window.

---

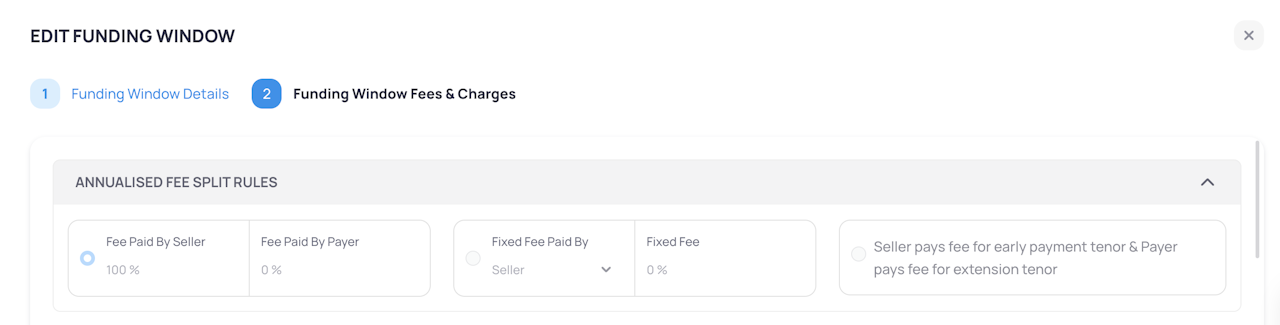

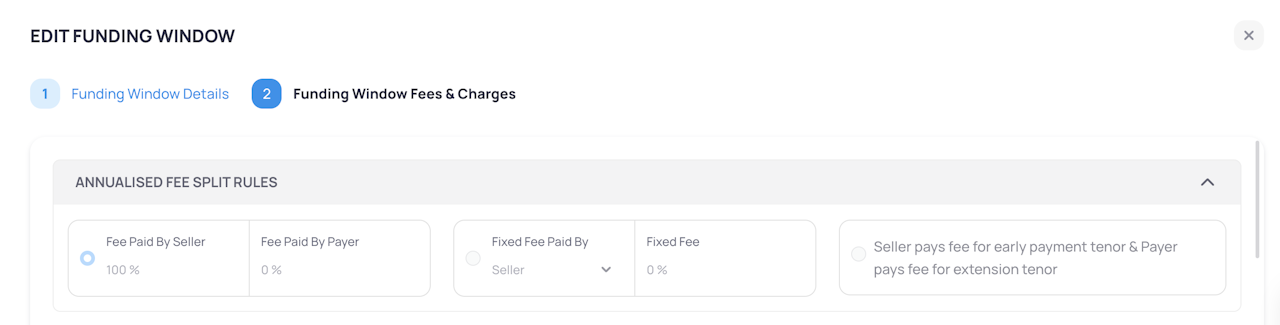

Annualised fee split rules

Annualised fee split rules define which party pays the running interest-type fees (seller vs payer) and how that obligation is allocated.

Ratio-based fee split (Fee Paid by Seller / Fee Paid by Payer): A percentage share between seller and payer that must always add up to 100; this drives who is charged for annualised fees and how much.

Fixed fee split (Fixed Fee Paid by …): A fixed amount (up to the Total Standard Fee) charged entirely to either seller or payer.

Tenor-based fee split (Seller pays fee for early payment tenor, Payer pays fee for extension tenor): When enabled, seller pays the fee for the original tenor and payer pays for any maturity extension.

Please note: it is auto‑disabled if the repaying party is the seller, Max Maturity Extension is 0, or the instrument type is Loan/PO.

These rules control how any configured annualised fee and late annualised fee are split between parties in all downstream calculations and instrument views.

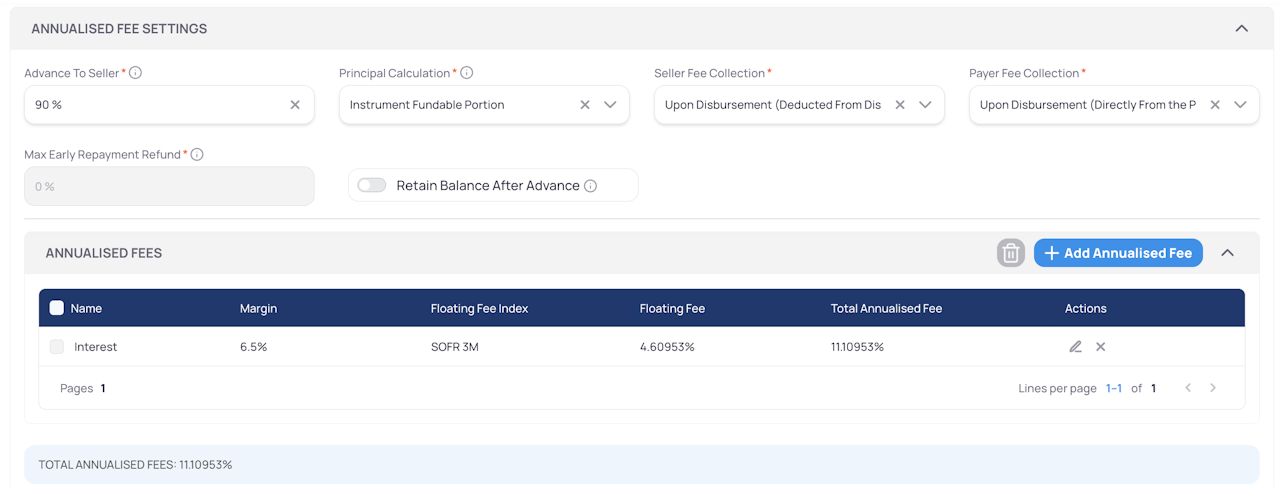

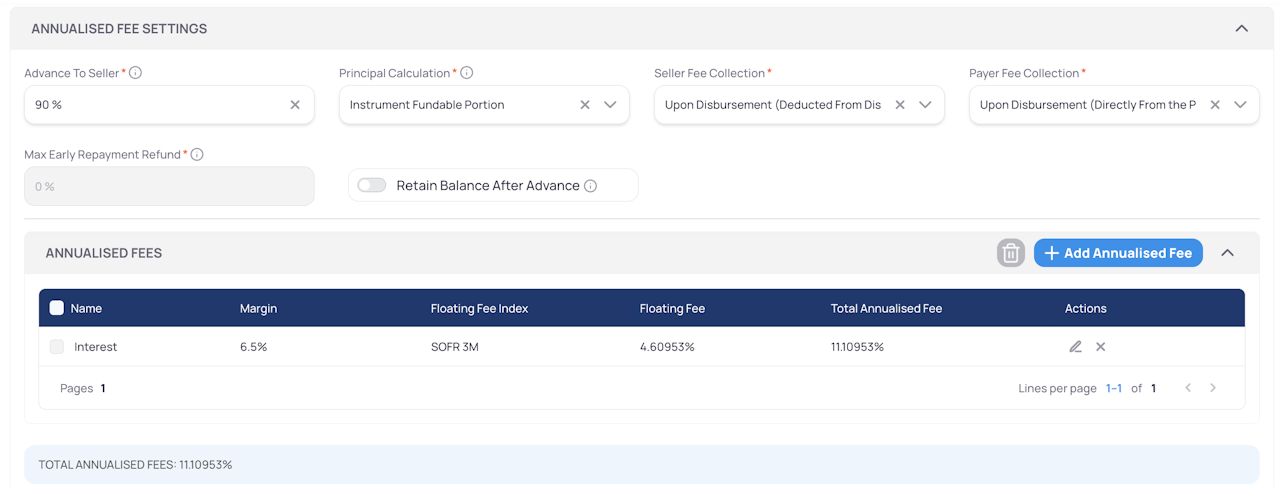

Annualised fee settings and annualised fees

Annualised fee settings are configured in the Funding Window Fees & Charges step of the deal and define the actual interest margins and floating indices used.

Advance Percentage to Seller

Advance % to Seller: This value sets the percentage of the instrument’s face value that will be disbursed to the seller upon funding.

The range is 0 to 100% and it is a mandatory field in the funding window configuration.

Instrument Fundable Portion: The principal is based on the portion of the face value that is being financed. For most transactions, this means the portion advanced to the seller.

Seller Fee Calculation

Seller Annualised Fee:

Seller fee can be set to be collected “Upon Disbursement”, “Deducted from Disbursement”, or “Upon Repayment”.

If “Collect Seller Fee in Arrears” is enabled, the system adds seller annualised fees to the repayment amount instead of deducing them upfront.

The default collection setting is “Upon Repayment”, but this can be changed as per deal requirements.

Payer Fee Calculation

Payer Annualised Fee:

Payer fees can be configured to be “Upon Disbursement”, “Directly From the Payer”, or “Upon Repayment”.

Standard annualised fee rows: Each row has a unique name, margin, floating fee index, derived floating fee, and a resulting Total Annualised Fee (margin + floating).

Total Standard Fee: The system shows the sum of all annualised fee rows.

Max Early Repayment Refund: A percentage cap that controls how much of accrued annualised fees can be refunded on early repayment; must be 0 unless all annualised fees are collected in arrears and the principal is calculated on Instrument Fundable Portion.

Once a deal is active, the configured annualised fees are stored in funding-window snapshots and used to compute expected annualised fees per instrument (both seller and payer shares, advance and arrears).

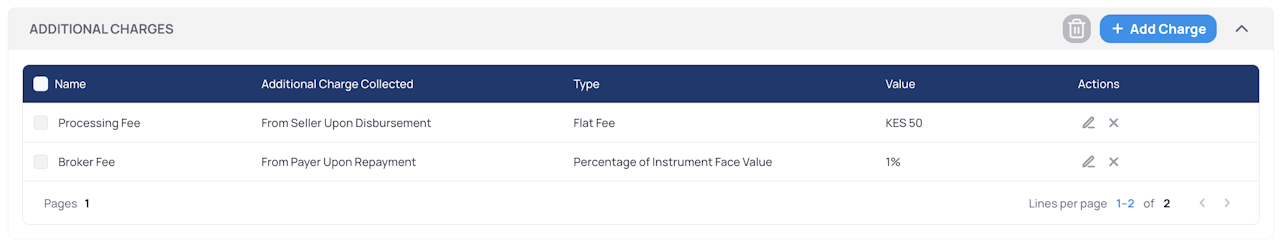

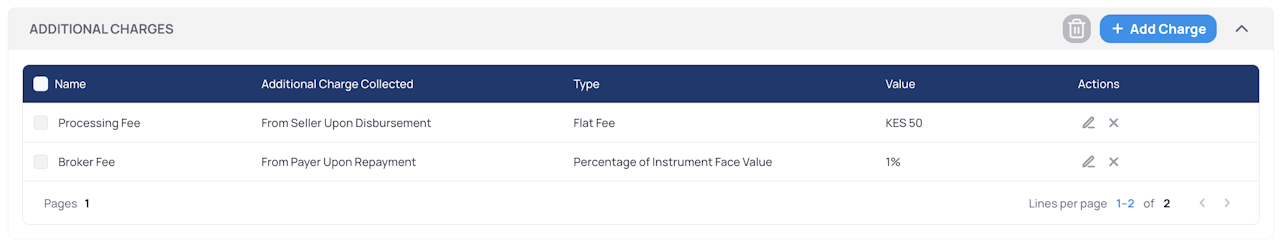

Additional charges

Additional charges are one‑off or fixed fees (non‑annualised) that are also configured per funding window and then applied on each funded instrument.

Charge definition: Each additional charge has a unique name, type (flat amount, % of face value, % of fundable portion, or % of principal), and a value with minimum/maximum validation.

Collection rule: The “Additional Charge Collected” field defines who pays and when (From Seller Upon Disbursement / Upon Repayment, From Payer Upon Disbursement / Upon Repayment), and this drives whether the fee is taken upfront or in arrears.

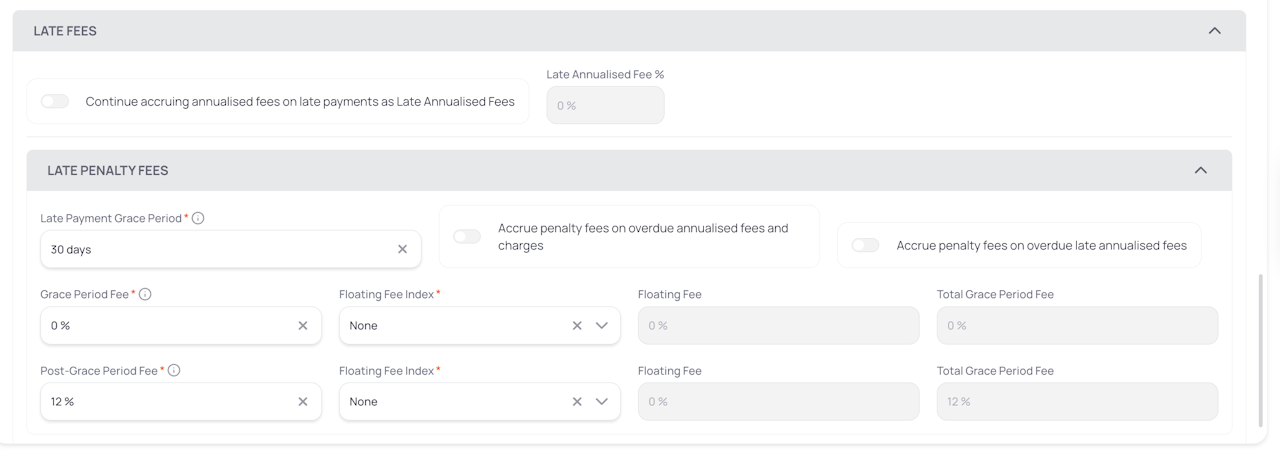

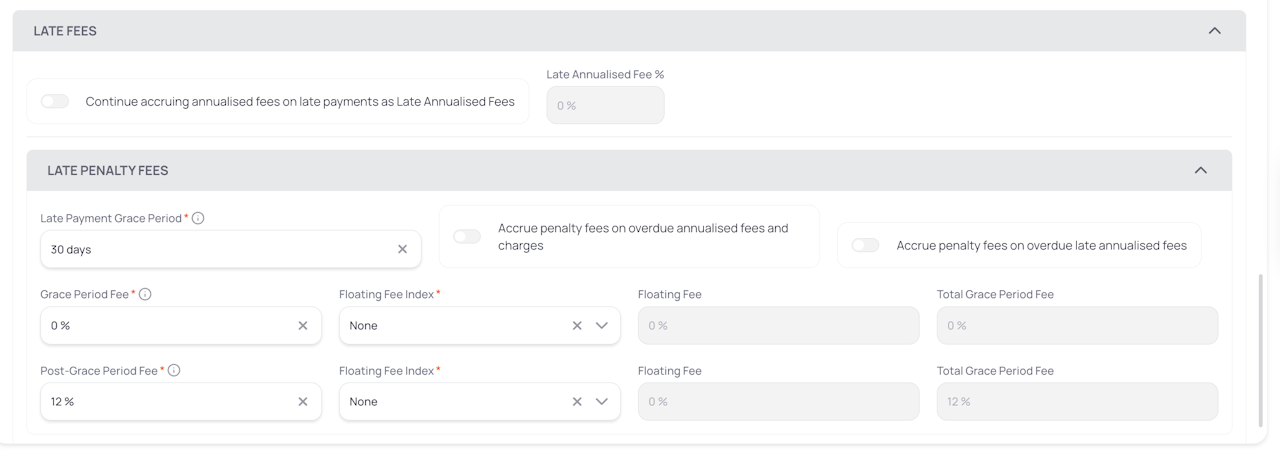

Late Fees

Late fees are configured under the Late Payment section of the funding window.

Annualised fees accrue on the instrument’s principal or fundable portion up until the repayment date. Once the repayment date passes without payment, the system stops accruing them as regular annualised fees and instead begins accruing them as late annualised fees. These late annualised fees continue to accumulate until the outstanding amount is settled.

In essence, the total interest obligation is split into two phases:

Before repayment date: Regular annualised fees apply.

After repayment date: Late annualised fees apply, typically with potentially different margin rates or conditions.

Continue accruing standard fee on late payments: When this toggle is enabled, the system continues to apply the standard Total Annualised Fee beyond the original repayment date. If it's disabled

Late Annualised Fees: All standard annualised fees that accrue after the instrument becomes overdue are tracked as Late Annualised Fees, with separate cumulative and outstanding fields per party and at total level.

Grace period configuration: Late Payment Grace Period (days) defines how long after the due date payments can be made before late penalty fees start; during this time, you can still have Late Annualised Fees accruing if the “continue accruing” toggle is on.

---

Late penalty fees and related penalty toggles

Late penalty fees are additional annualised-style penalties (separate from standard annualised fees) that apply once an instrument passes due date and grace period.

Grace Period Late Penalty: Configured as floating + margin to produce a Total Grace Period Fee; applied during the grace period if you choose to charge penalty fees even while in grace.

Post‑Grace Period Late Penalty: Separate floating + margin that gives the Total Post‑Grace Period Fee, which applies after the grace period has ended.

All late penalty accruals are stored and exposed as Late Penalty Grace Period Fees, Late Penalty Post‑Grace Period Fees, and their outstanding balances within the repayments and instrument card views.

Penalty fees on overdue annualised fees and overdue late annualised fees

Beyond the basic late penalty on principal and unfinanced balance, there are dedicated toggles to capitalise penalty fees on overdue fee components themselves.

Accrue penalty fees on overdue annualised fees and charges:

When enabled, any annualised fees in arrears and additional charges that remain unpaid after due date become a base for further penalty accrual, increasing the total Late Penalty Fees.

These amounts appear as Outstanding Accrued Annualised Fees and Outstanding Additional Charges, and are included in penalty calculations until fully settled.

Accrue penalty fees on overdue late annualised fees:

When enabled, any Late Annualised Fees that themselves remain unpaid start to attract additional penalty fees, effectively charging interest-on-interest for persistent non‑payment.

The system tracks cumulative Late Annualised Fees, Late Penalty Fees, and their outstanding portions, and includes them in the total repayment amount until reconciled.

These penalty toggles ensure that all unpaid fee components (standard annualised, additional charges, and late annualised) can themselves become interest‑bearing once overdue, fully reflected in repayment quotes, repayment files, and the instrument fee split summaries.