Create an PO Finance Product

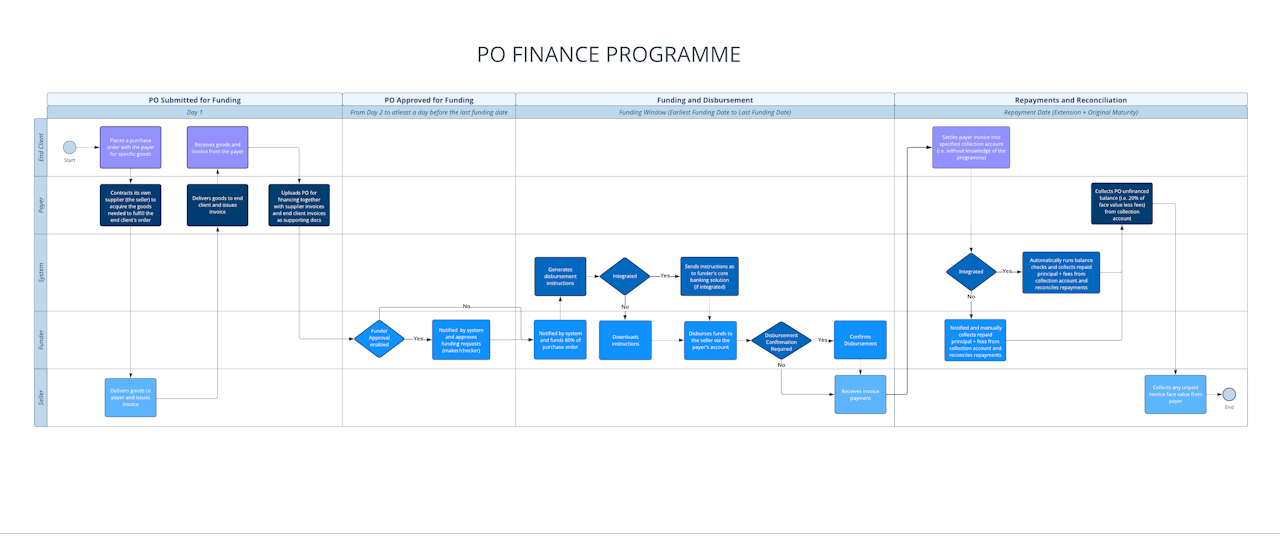

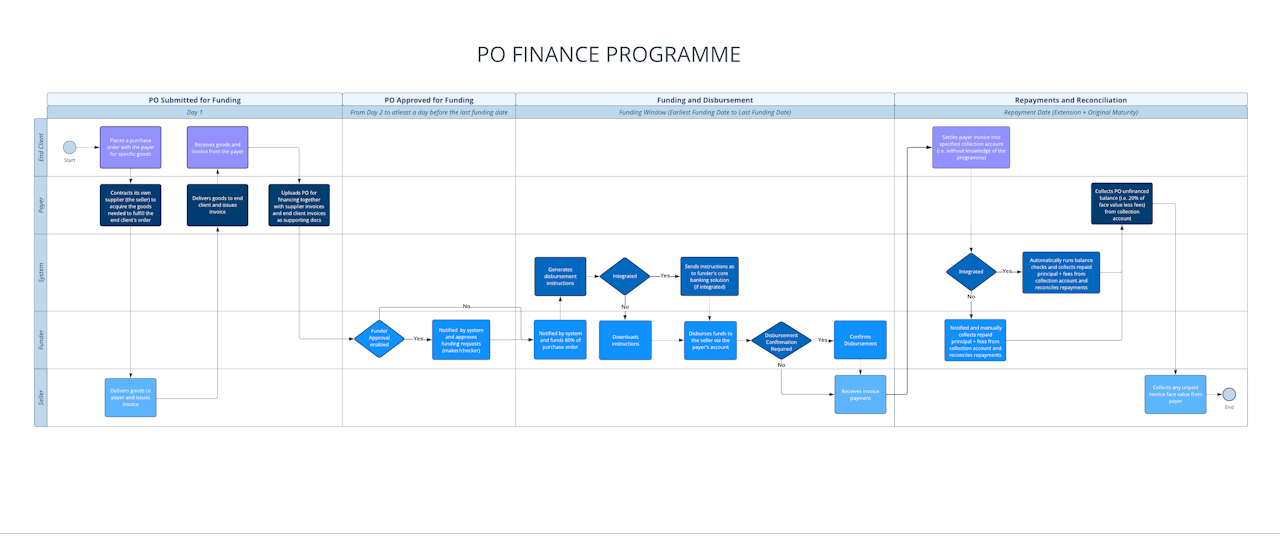

A loan provided to a seller for producing their goods as ordered by a buyer. The financing is typically repaid upon invoice date/delivery of goods by the seller, drawing down on a receivables financing facility.

In order to create a PO Finance Product you need to:

Create a Product Group and Structure for an PO Finance Product

Apply the created Product to a Deal

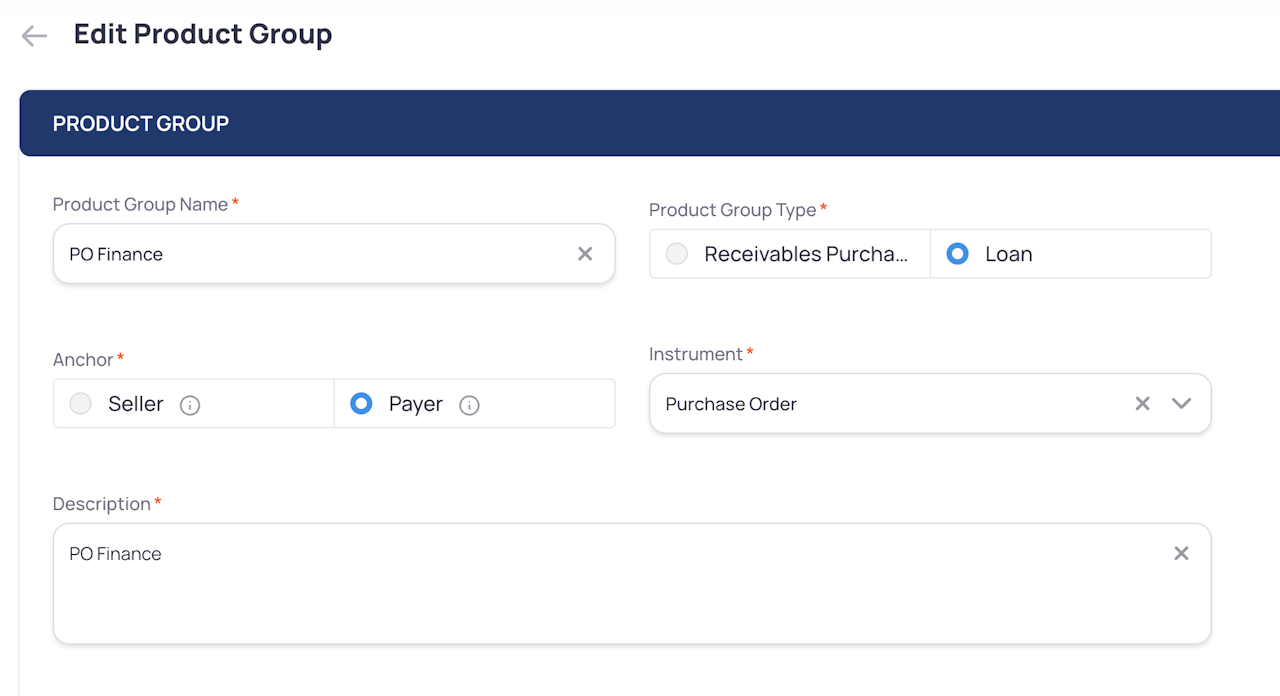

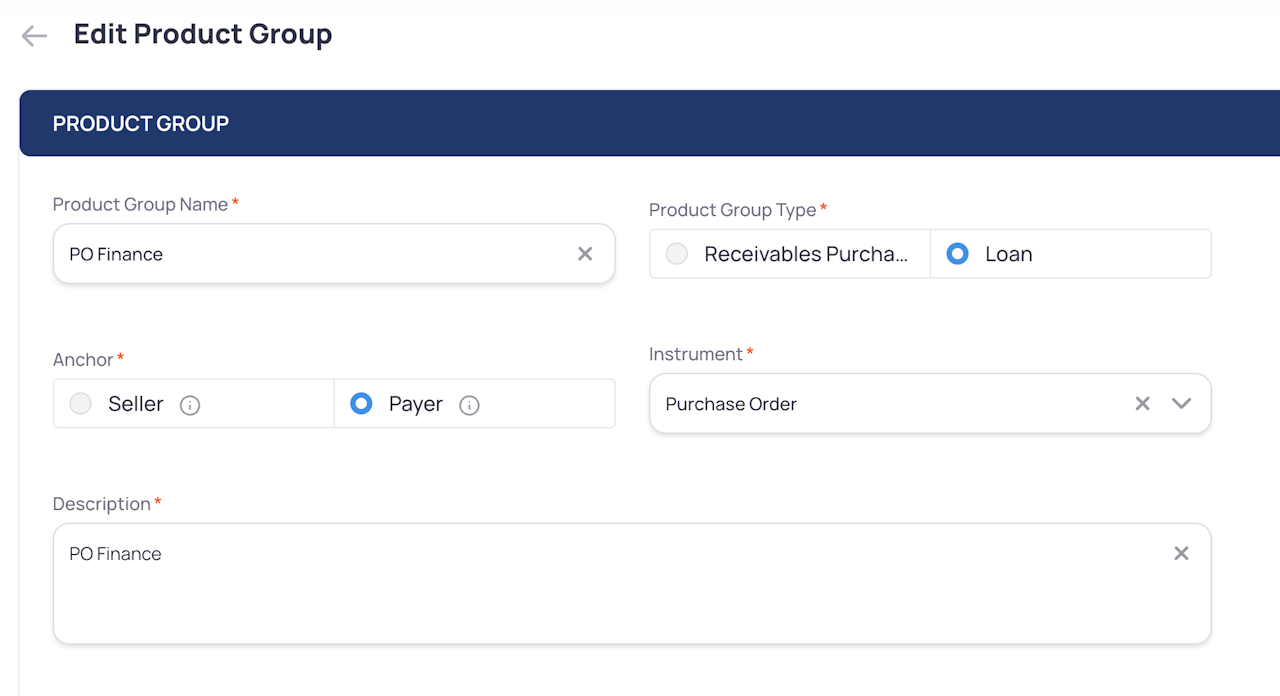

Product Group

Product Groups work as your product templates. Once you set up a specific Product, it can be used for multiple programmes and clients.

Name | Unique and recognisable for your Team |

Anchor | Buyer usually has many sellers, issuing multiple POs for different products. |

Type | Loan / pre-shipment finance (not a receivables purchase) Financing occurs before an invoice exists |

Underlying instrument | Purchase Order from buyer |

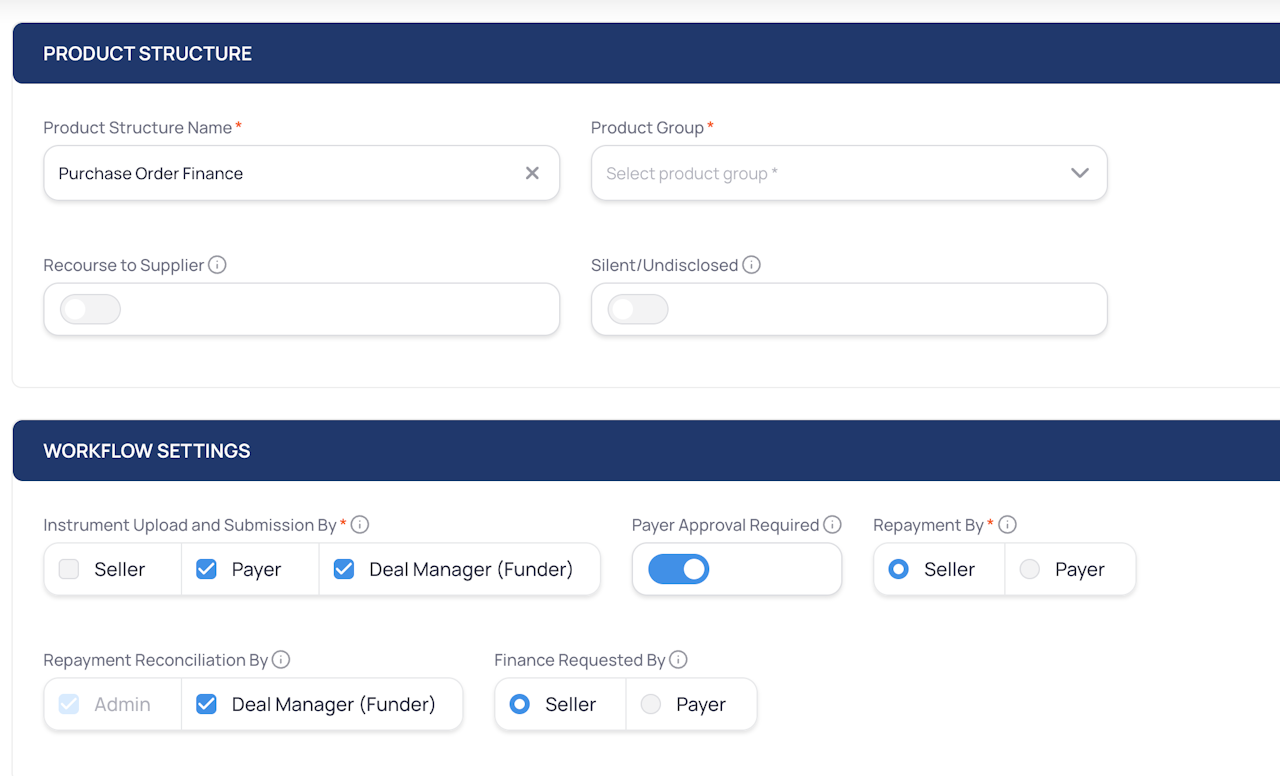

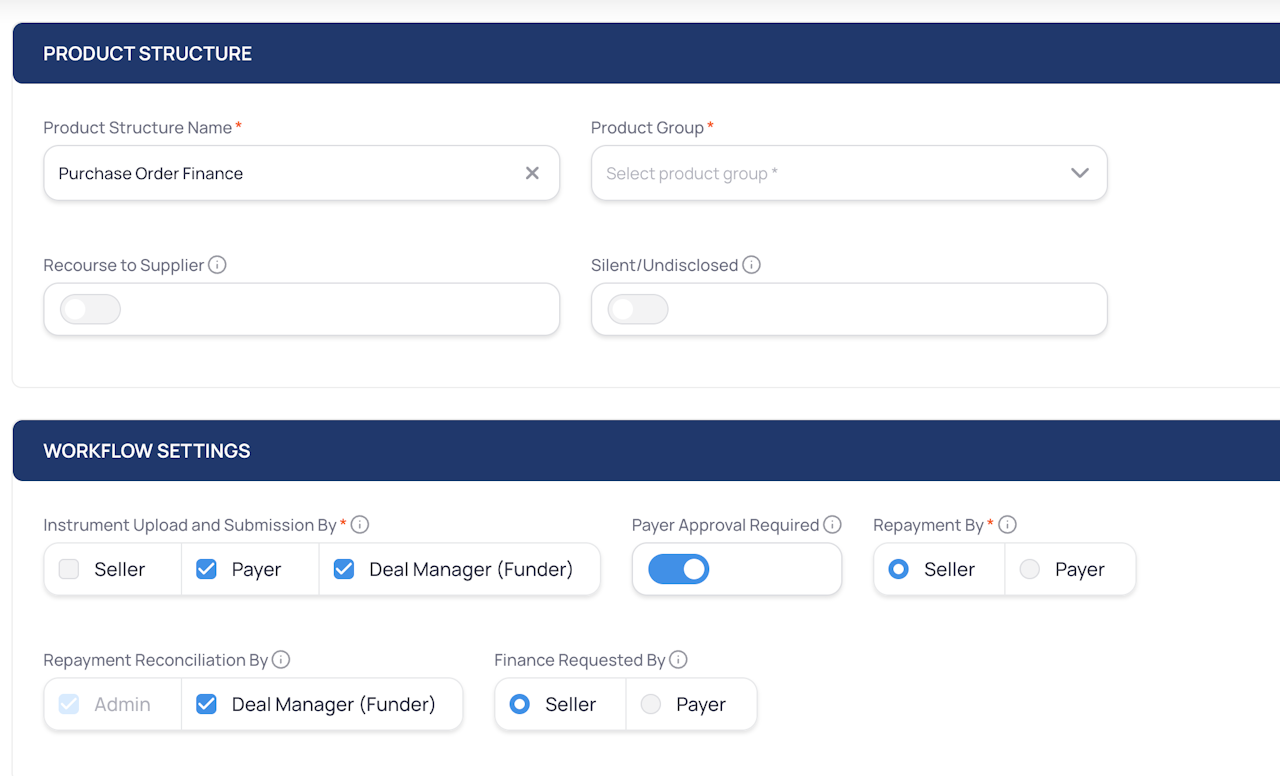

Product Structure

Product Structures define the workflows of your products. They are specified after the product group, as the structure and workflows within it directly influence the product you select.

Similarly to Product Groups they work as templates and can be assigned to multiple clients/ Deals.

Field | Details |

|---|---|

Name | Assign a name that refers to a specific point of the workflow ex. PO Finance |

Product Group | Choose the name of the Group you have just created in the previous step |

Recourse to Supplier | Non-recourse to the supplier (standard) |

Silent/Undisclosed | Typically disclosed to suppliers |

Workflow settings

Instrument Upload/ Submission by | Buyer typically uploads a purchase order |

Payer approval required | Optional, but lender typically verifies the PO is authentic with the buyer |

Repayment by | Seller |

Repayment Reconciliation By | Admin or Deal Manager (Funder) |

Finance requested by | Seller, to get funds to fulfill the order. |