Reverse Factoring

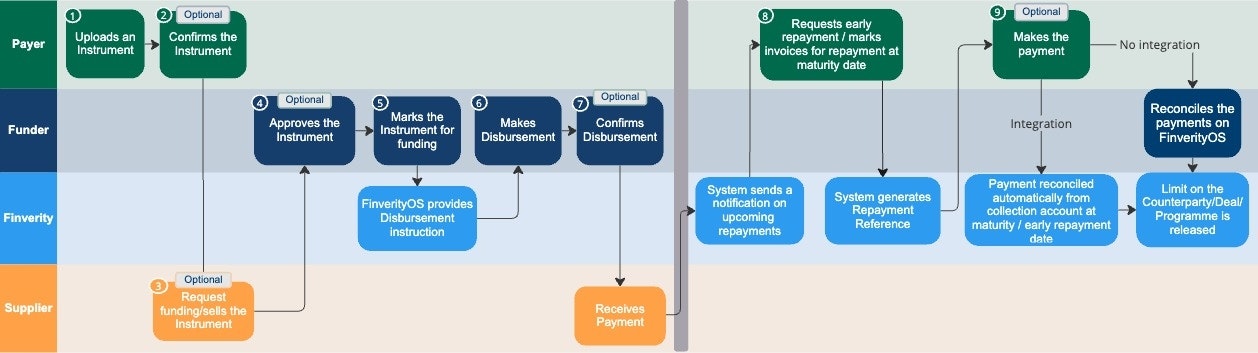

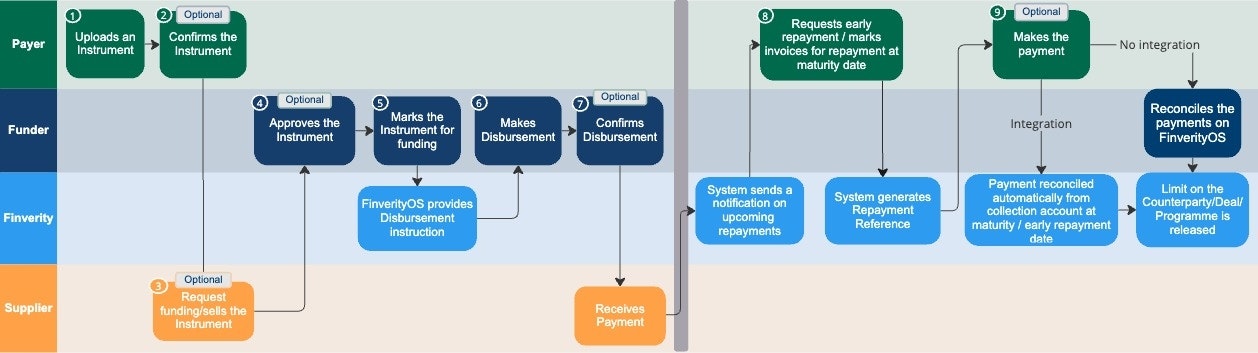

Reverse Factoring – lets buyers offer an early payment option to their suppliers based on approved invoices.

Suppliers sell/reassign the invoices to a third-party funder in exchange for a discounted early payment. Buyers then pay the full invoice value to the third-party funder on maturity date - typically under an Irrevocable Payment Undertaking.

Linking a buyer, their supplier, and a funder, Payables Finance reduces the corporate’s supply chain risk and expands the supplier’s finance options.

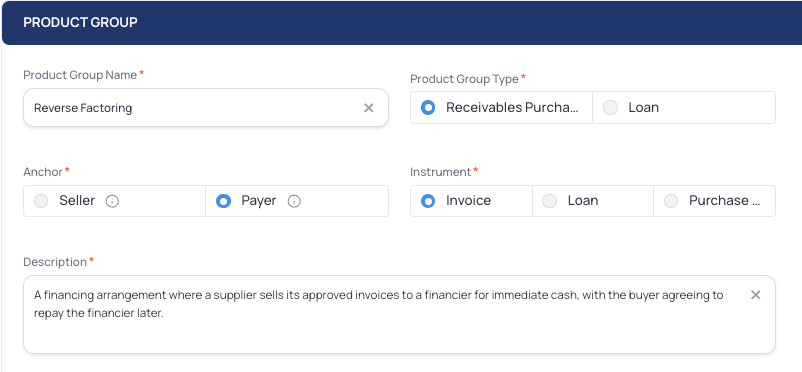

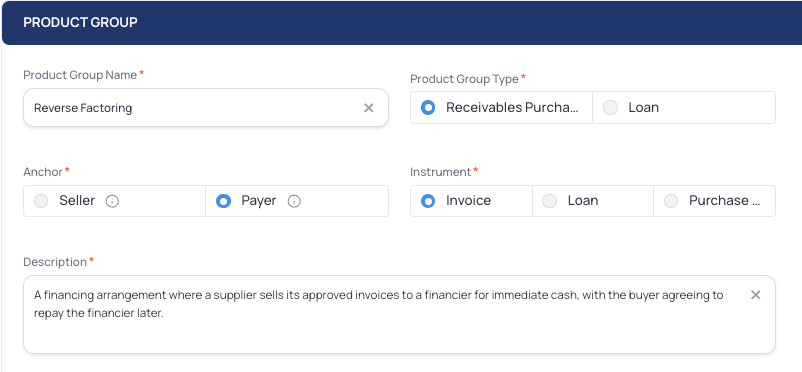

Product Group

Product Groups work as your product templates. Once you set up a specific Product, it can be used for multiple programmes and clients.

Field | Details |

|---|---|

Name | Unique and recognisable for your Team ex. Reverse Factoring or Approved Payables Finance |

Type | Receivables purchase (true sale) of supplier’s receivable after buyer approval. Financier buys the supplier’s receivable that is owed by the buyer. |

Anchor | Payer / Buyer is always the anchor (the credit risk driver) |

Instrument | Invoice |

Description | Description of your choosing ex.A financing arrangement where a supplier sells its approved invoices to a financier for immediate cash, with the buyer agreeing to repay the financier later. |

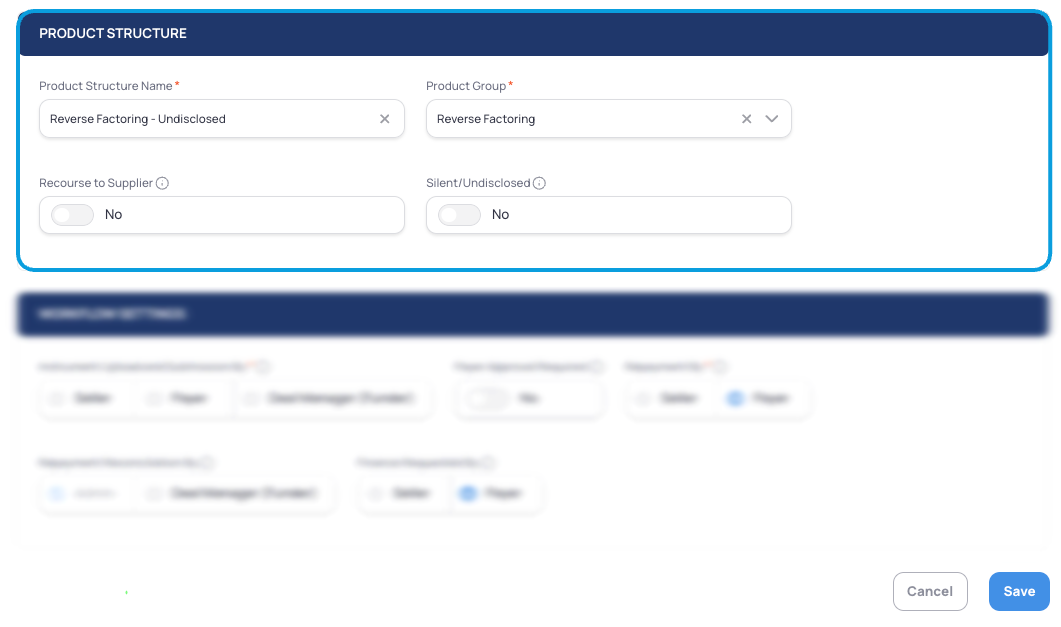

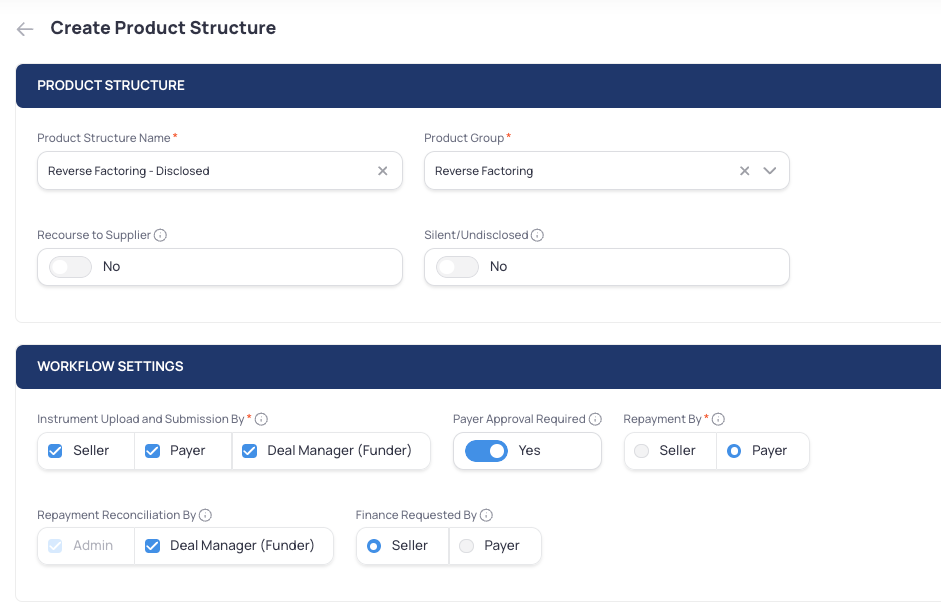

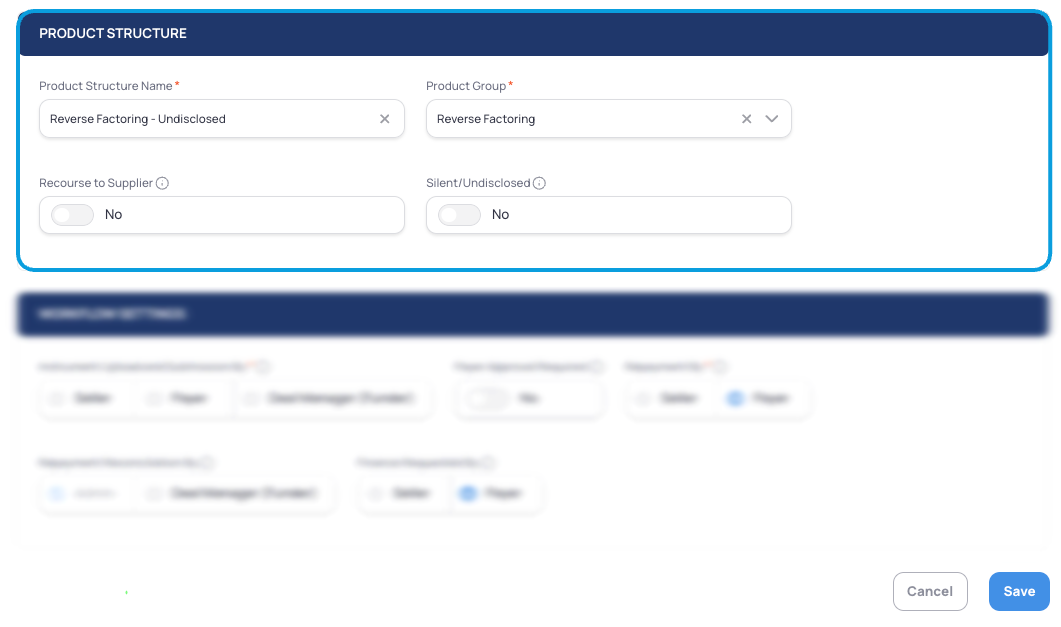

Product Structure

Product Structures define the workflows of your products. They are specified after the product group, as the structure and workflows within it directly influence the product you select.

Similarly to Product Groups they work as templates and can be assigned to multiple clients/ Deals.

Field | Details |

|---|---|

Name | Assign a name that refers to a specific point of the workflow ex. Reverse Factoring - Undisclosed |

Product Group | Choose the Product Group you just created ex. Reverse Factoring |

Recourse to Supplier | Non-recourse to the supplier (standard) |

Silent/Undisclosed | Typically disclosed to suppliers |

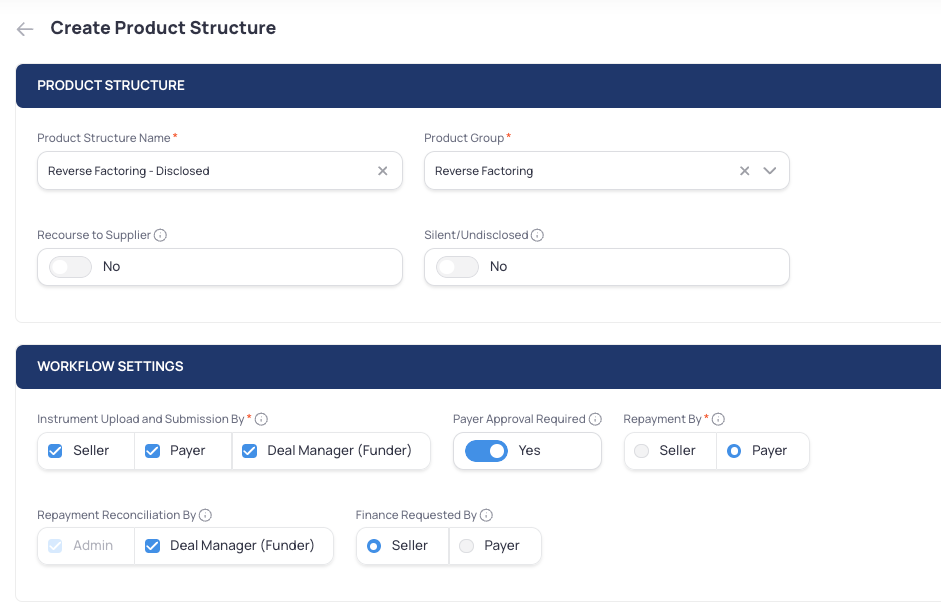

Workflow Settings

Field | Details |

|---|---|

Instrument Upload/ Submission by | Typically Buyer uploads, but any party can also upload |

Payer approval required | Yes. Reverse factoring is based on buyer-approved payables |

Repayment by | Payer/ Buyer pays the financier on invoice maturity |

Repayment Reconciliation By | Admin/ (Deal Manager) Funder |

Finance requested by | Seller requests early payment after the buyer has approved (this can be automated under a Deal) |