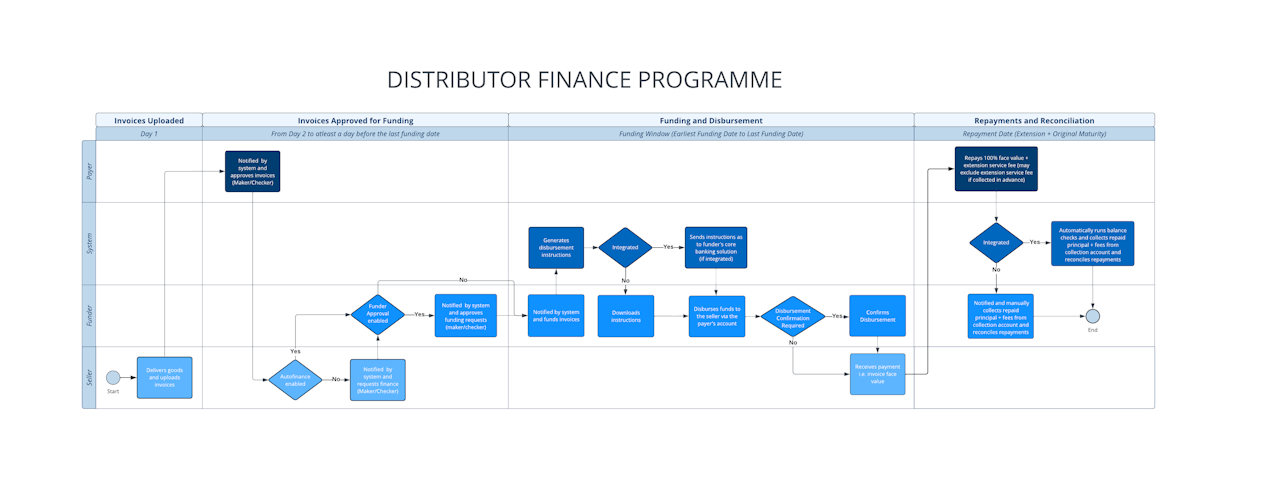

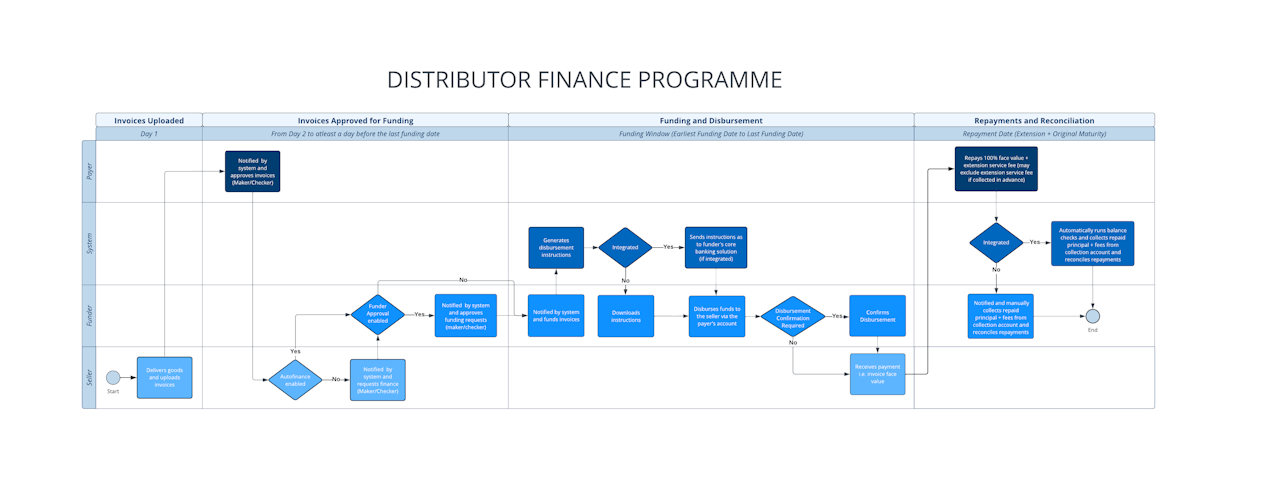

Create a Distributor Finance Product

Distributor finance involves financial arrangements designed to support distributors within a supply chain. It typically involves a financial institution providing funding to distributors to help them purchase inventory from suppliers.

In order to create a Distributor Finance Product you need to:

Create a Product Group and Structure for an Distributor Finance Product

Apply the created Product to a Deal

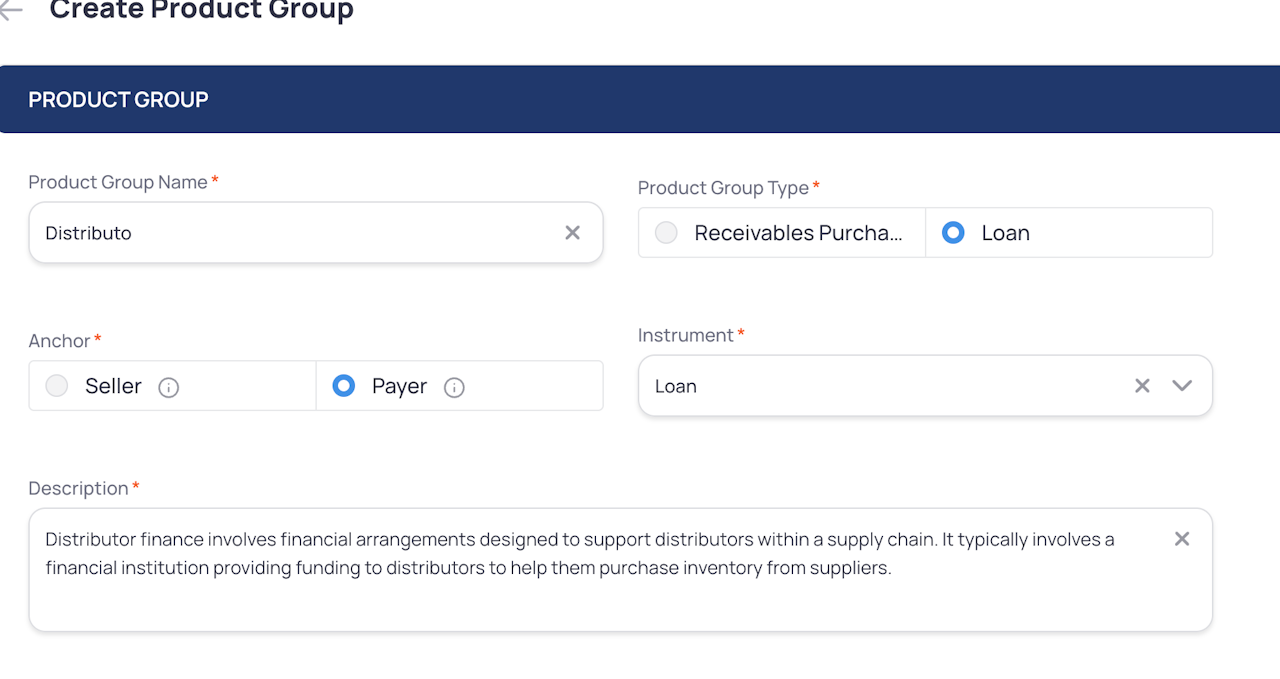

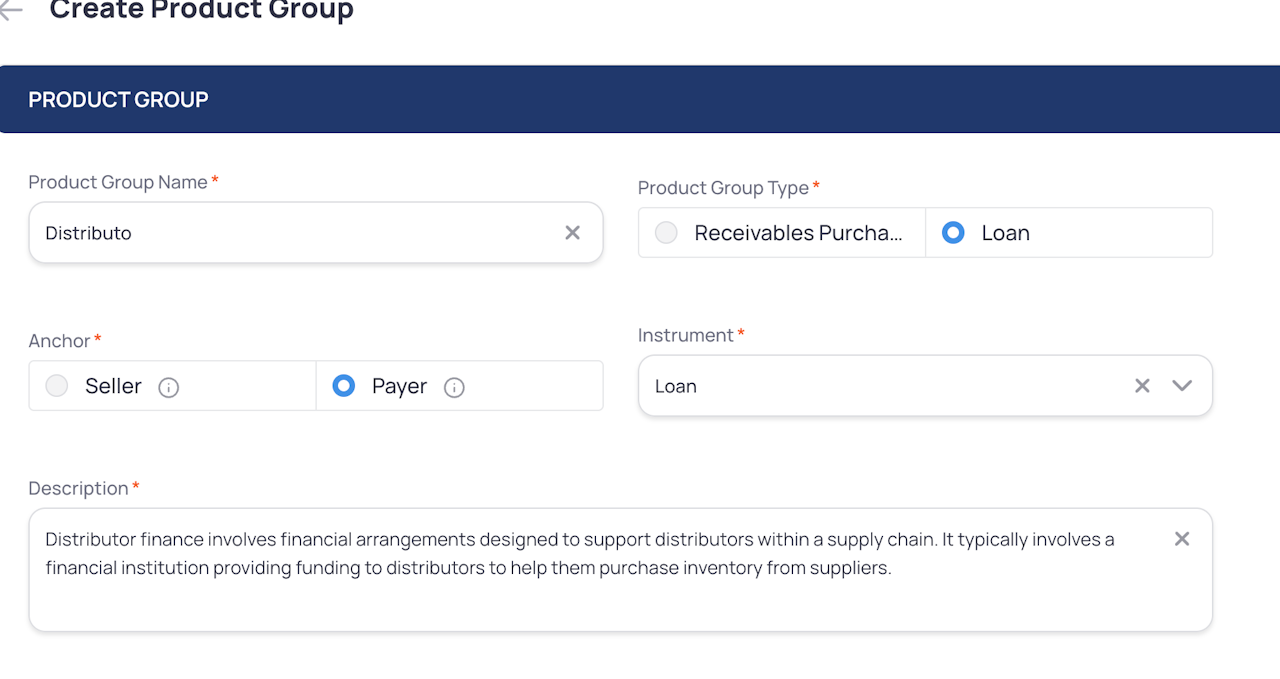

Product Group

Product Groups work as your product templates. Once you set up a specific Product, it can be used for multiple programmes and clients.

Name | Unique and recognisable for your Team |

Anchor | Anchor: A distributor typically buys from multiple manufacturers/suppliers. |

Product Type | Loan or credit line to the distributor (sometimes secured against inventory or future receivables) |

Underlying instrument | Loan agreement or Seller invoice to the distributor |

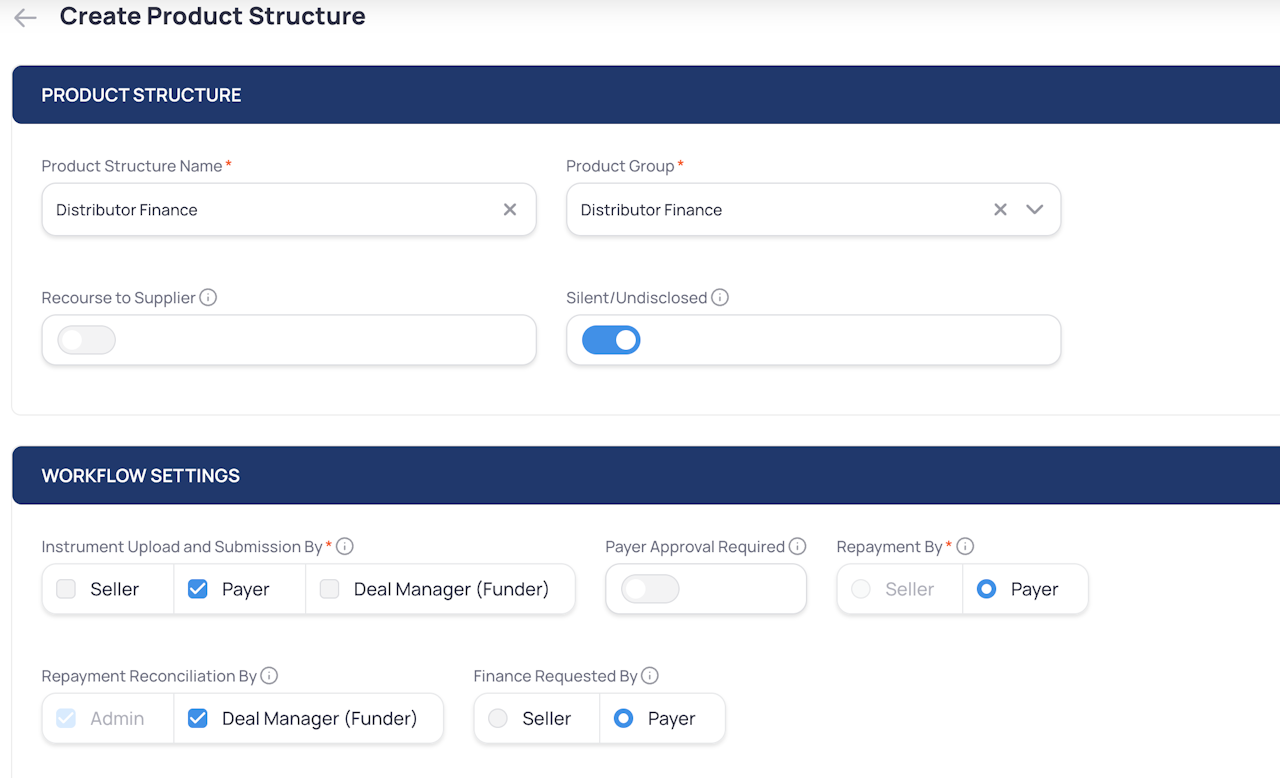

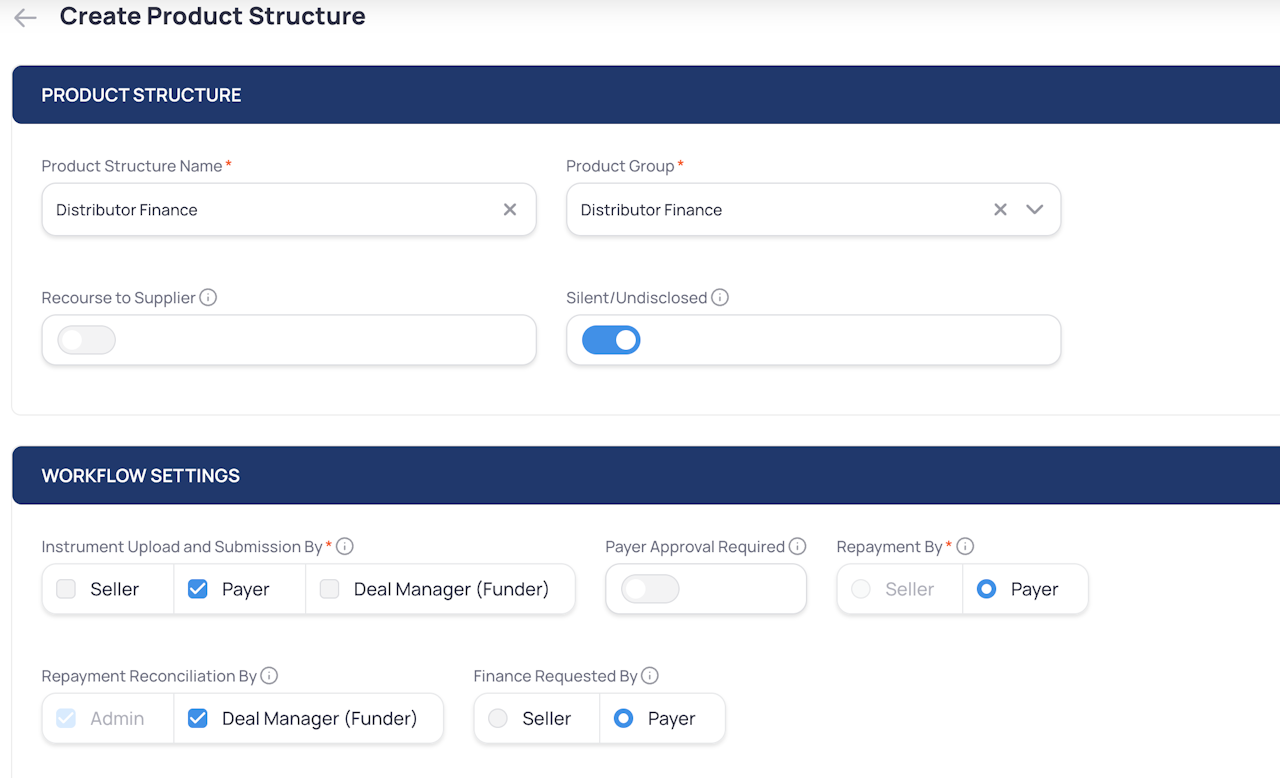

Product Structure

Product Structures define the workflows of your products. They are specified after the product group, as the structure and workflows within it directly influence the product you select.

Similarly to Product Groups they work as templates and can be assigned to multiple clients/ Deals.

Name | Distributor Finance |

Product Group | Choose the name of the Group you have just created in the previous step |

Recourse to the supplier | No Recourse is to the distributor - there is no buyer-approved receivable purchase. |

Silent/Undisclosed | Typically no |

Workflow settings

Instrument Upload/ Submission by | Payer |

Payer approval required | Typically no |

Repayment by | Payer (distributor) repays the financier. |

Repayment Reconciliation By | Admin or Deal Manager (Funder) |

Finance requested by | Payer (distributor) requesting financing to pay the seller. |